Your Broker Has a Duty of “Best Execution”

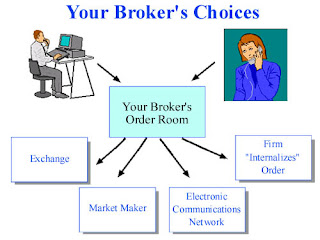

Many firms use automated systems to handle the orders they receive from their customers. In deciding how to execute orders, your broker has a duty to seek the best execution that is reasonably available for its customers' orders. That means your broker must evaluate the orders it receives from all customers in the aggregate and periodically assess which competing markets, market makers, or ECNs offer the most favorable terms of execution.

The opportunity for "price improvement" – which is the opportunity, but not the guarantee, for an order to be executed at a better price than what is currently quoted publicly – is an important factor a broker should consider in executing its customers' orders. Other factors include the speed and the likelihood of execution.

Here's an example of how price improvement can work: Let's say you enter a market order to sell 500 shares of a stock. The current quote is $20. Your broker may be able to send your order to a market or a market maker where your order would have the possibility of getting a price better than $20. If your order is executed at $20 1/16, you would receive $10,031.25 for the sale of your stock – $31.25 more than if your broker had only been able to get the current quote for you.

Of course, the additional time it takes some markets to execute orders may result in your getting a worse price than the current quote – especially in a fast-moving market. So, your broker is required to consider whether there is a trade-off between providing its customers' orders with the possibility – but not the guarantee – of better prices and the extra time it may take to do so.

You Have Options for Directing Trades

If for any reason you want to direct your trade to a particular exchange, market maker, or ECN, you may be able to call your broker and ask him or her to do this. But some brokers may charge for that service. Some brokers now offer active traders the ability to direct orders in Nasdaq stocks to the market maker or ECN of their choice.

In a recent speech, SEC Chairman Arthur Levitt emphasized that investors have the right to know where and how their firms execute their orders and what steps they take to assure best execution.

Ask your broker about the firm's policies on payment for order flow, internalization, or other routing practices – or look for that information in your new account agreement. You can also write to your broker to find out the nature and source of any payment for order flow it may have received for a particular order.

If you're comparing firms, ask each how often it gets price improvement on customers' orders. And then consider that information in deciding with which firm you will do business.

The opportunity for "price improvement" – which is the opportunity, but not the guarantee, for an order to be executed at a better price than what is currently quoted publicly – is an important factor a broker should consider in executing its customers' orders. Other factors include the speed and the likelihood of execution.

ReplyDelete